e-Invoicing in Europe

User Guide / e-Invoicing în Europe- General information

- Interoperability of e-Invoicing

- What is PEPPOL?

- VAT invoicing EU rules

- When TAX invoice is mandatory?

- Mandatory details of EU Tax invoice

- The common system of VAT in EU

EU e-invoicing is the exchange of an electronic invoice between supplier and buyer.

An electronic invoice (e-Invoice) is an invoice that has been issued, transmitted and received in a structured data format which allows for its automatic and electronic processing, as defined in Directive 2014/55.

DIGITAL e-Invoicing building block

Benefits of EU e-Invoicing

-

Cost reduction

Being an automated invoicing tool, eInvoicing reduces processing costs and operational services. -

Faster payment

By removing the need of manually reading and entering information, eInvoicing lessens administrative burdens and time-to-payment for individual invoices. -

Boosting B2G eProcurement

eInvoicing helps companies manage their contracts in any EU country, making public procurement businesses more appealing for everyone. -

Facilitating cross-border trade

The timely and automatic processing of companies’ invoices in the EU facilitates cross-border trade operations between countries.

Who can benefit from e-Invoicing

-

Public Entities

Public sector contracting authorities

e-Invoicing services can help you start receiving electronic invoices from all across Europe. -

Suppliers

Entities doing business using the European standard on eInvoicing

We can help you prepare and send electronic invoices compliant with European standards. -

Service and Solution Providers

e-Invoicing service and software providers

We can help you develop and deliver eInvoicing services and software that are compliant with EU standards.

Implementing eInvoicing

If you are ready to get started with implementing e-invoicing capabilities, we are ready to help you.

Electronic invoicing is the exchange of an electronic invoice document between a supplier and a buyer. An electronic invoice (eInvoice) is an invoice that has been issued, transmitted and received in a structured data format which allows for its automatic and electronic processing, as defined in Directive 2014/55/EU.

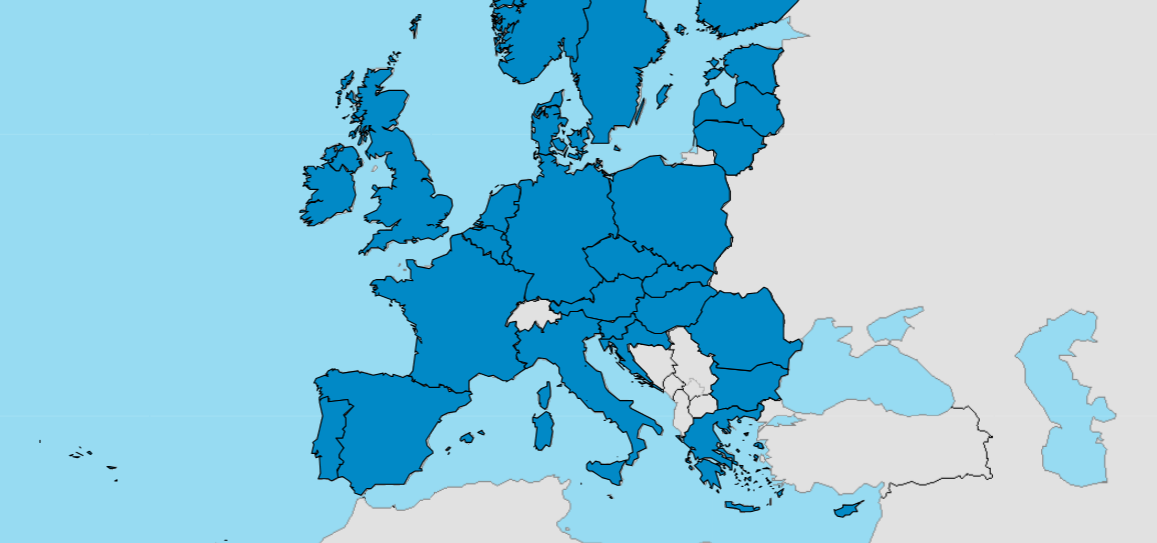

Our team aims at promoting the uptake and accelerating the use of eInvoicing in respect of the European standard, amongst both private and public entities established in the EU, as well as in participating EEA countries, including Moldova.

e-Invoicing EU can be used not only to Government to Government communication (G2G) but also to enable acelarating Business to Government (B2G), as well as in the private sector for Business to Business (B2B) transactions.

It shoud be noted that Business to Business (B2B) and Government to Citizen (G2C) or Business to Consumer (B2C) are not addressed in the context of the eInvoicing Directive.